Healthcare Factoring

Get paid on your insurance receivables in 24 hours!

Factoring provides healthcare providers with a fast, reliable way to access cash by leveraging their insurance receivables. It’s an effective solution to manage cash flow, cover operational expenses, and invest in growth without taking on debt or waiting for lengthy insurance reimbursements.

With factoring, you can secure the funds you need to scale your practice, hire staff, or invest in technology—all while focusing on patient care. It’s a flexible alternative to traditional financing, with no added liabilities or repayment schedules to worry about.

Get Paid Faster

Unlock cash from insurance receivables and get funded in 24 hours.

Improve Financials

Boost cash flow, credit, and working capital, all without incurring debt.

Fuel Growth

Invest in expansion, hire new staff, and upgrade technology—all while maintaining financial flexibility.

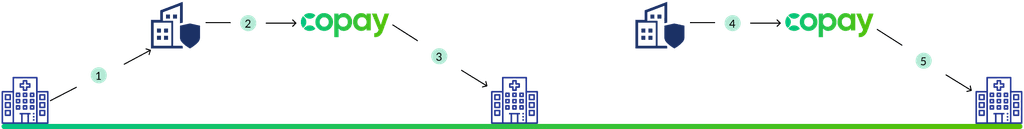

Factoring, or accounts receivable financing, helps healthcare providers access funds faster by unlocking cash from their insurance receivables. Copay advances up to 90% of your receivable within 24 hours, with the remaining balance paid on the original due date.

1

2

3

4

Insurance payors pay the claims into a control account

5

Can Copay fund your receivables?

If you check these box, the answers likely yes:

You are submitting your insurance claims and receiving payments for a minimum of 6 months.

Frequently Asked Questions

What is factoring and how does it work?

How quickly can I get funded?

What are the benefits of factoring with Copay?

Who qualifies for factoring with Copay?

Does factoring affect my credit score?